The Shutdown Point

The possibility that a firm may earn losses raises a question: Why can the firm not avoid losses by shutting down and not producing at all? The answer is that shutting down can reduce variable costs to zero, but in the short run, the firm has already paid for fixed costs. As a result, if the firm produces a quantity of zero, it would still make losses because it would still need to pay for its fixed costs. So, when a firm is experiencing losses, it must face a question: should it continue producing or should it shut down?

As an example, consider the situation of the Yoga Center, which has signed a contract to rent space that costs $10,000 per month. If the firm decides to operate, its marginal costs for hiring yoga teachers is $15,000 for the month. If the firm shuts down, it must still pay the rent, but it would not need to hire labor. Let’s take a look at three possible scenarios. In the first scenario, the Yoga Center does not have any clients, and therefore does not make any revenues, in which case it faces losses of $10,000 equal to the fixed costs. In the second scenario, the Yoga Center has clients that earn the center revenues of $10,000 for the month, but ultimately experiences losses of $15,000 due to having to hire yoga instructors to cover the classes. In the third scenario, the Yoga Center earns revenues of $20,000 for the month, but experiences losses of $5,000.

In all three cases, the Yoga Center loses money. In all three cases, when the rental contract expires in the long run, assuming revenues do not improve, the firm should exit this business. In the short run, though, the decision varies depending on the level of losses and whether the firm can cover its variable costs. In scenario 1, the center does not have any revenues, so hiring yoga teachers would increase variable costs and losses, so it should shut down and only incur its fixed costs. In scenario 2, the center’s losses are greater because it does not make enough revenue to offset the increased variable costs plus fixed costs, so it should shut down immediately. If price is below the minimum average variable cost, the firm must shut down. In contrast, in scenario 3 the revenue that the center can earn is high enough that the losses diminish when it remains open, so the center should remain open in the short run.

Should the Yoga Center Shut Down Now or Later?

Scenario 1

If the center shuts down now, revenues are zero but it will not incur any variable costs and would only need to pay fixed costs of $10,000.

profit = total revenue – (fixed costs + variable cost)

profit = 0 – $10,000 = –$10,000

Scenario 2

The center earns revenues of $10,000, and variable costs are $15,000. The center should shut down now.

profit = total revenue – (fixed costs + variable cost)

profit = $10,000 – ($10,000 + $15,000) = –$15,000

Scenario 3

The center earns revenues of $20,000, and variable costs are $15,000. The center should continue in business.

profit = total revenue – (fixed costs + variable cost)

profit = $20,000 – ($10,000 + $15,000) = –$5,000

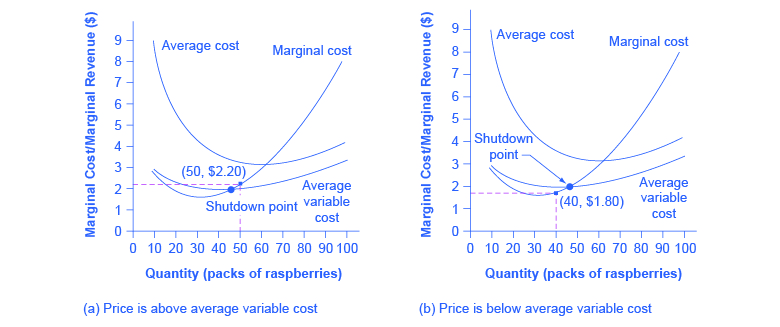

This example suggests that the key factor is whether a firm can earn enough revenues to cover at least its variable costs by remaining open. Let’s return now to our raspberry farm. Figure 8.6 illustrates this lesson by adding the average variable cost curve to the marginal cost and average cost curves. At a price of $2.20 per pack, as shown in Figure 8.6 (a), the farm produces at a level of 50. It is making losses of $56 (as explained earlier), but price is above average variable cost and so the firm continues to operate. However, if the price declined to $1.80 per pack, as shown in Figure 8.6 (b), and if the firm applied its rule of producing where P = MR = MC, it would produce a quantity of 40. This price is below average variable cost for this level of output. If the farmer cannot pay workers (the variable costs), then it has to shut down. At this price and output, total revenues would be $72 (quantity of 40 times price of $1.80) and total cost would be $144, for overall losses of $72. If the farm shuts down, it must pay only its fixed costs of $62, so shutting down is preferable to selling at a price of $1.80 per pack.

Figure 8.6. The Shutdown Point for the Raspberry Farm. In (a), the farm produces at a level of 50. It is making losses of $56, but price is above average variable cost, so it continues to operate. In (b), total revenues are $72 and total cost is $144, for overall losses of $72. If the farm shuts down, it must pay only its fixed costs of $62. Shutting down is preferable to selling at a price of $1.80 per pack.

Looking at Table 8.6, if the price falls below $2.05, the minimum average variable cost, the firm must shut down.

Table 8.6. Cost of Production for the Raspberry Farm

| Quantity | Total Cost |

Fixed Cost |

Variable Cost |

Marginal Cost |

Average Cost |

Average Variable Cost |

|---|---|---|---|---|---|---|

| 0 | $62 | $62 | – | – | – | – |

| 10 | $90 | $62 | $28 | $2.80 | $9.00 | $2.80 |

| 20 | $110 | $62 | $48 | $2.00 | $5.50 | $2.40 |

| 30 | $126 | $62 | $64 | $1.60 | $4.20 | $2.13 |

| 40 | $144 | $62 | $82 | $1.80 | $3.60 | $2.05 |

| 50 | $166 | $62 | $104 | $2.20 | $3.32 | $2.08 |

| 60 | $192 | $62 | $130 | $2.60 | $3.20 | $2.16 |

| 70 | $224 | $62 | $162 | $3.20 | $3.20 | $2.31 |

| 80 | $264 | $62 | $202 | $4.00 | $3.30 | $2.52 |

| 90 | $324 | $62 | $262 | $6.00 | $3.60 | $2.91 |

| 100 | $404 | $62 | $342 | $8.00 | $4.04 | $3.42 |

The intersection of the average variable cost curve and the marginal cost curve, which shows the price where the firm would lack enough revenue to cover its variable costs, is called the shutdown point. If the perfectly competitive firm can charge a price above the shutdown point, then the firm is at least covering its average variable costs. It is also making enough revenue to cover at least a portion of fixed costs, so it should limp ahead even if it is making losses in the short run, since at least those losses will be smaller than if the firm shuts down immediately and incurs a loss equal to total fixed costs. However, if the firm is receiving a price below the price at the shutdown point, then the firm is not even covering its variable costs. In this case, staying open is making the firm’s losses larger, and it should shut down immediately. To summarize, if:

- price < minimum average variable cost, then firm shuts down

- price = minimum average variable cost, then firm stays in business

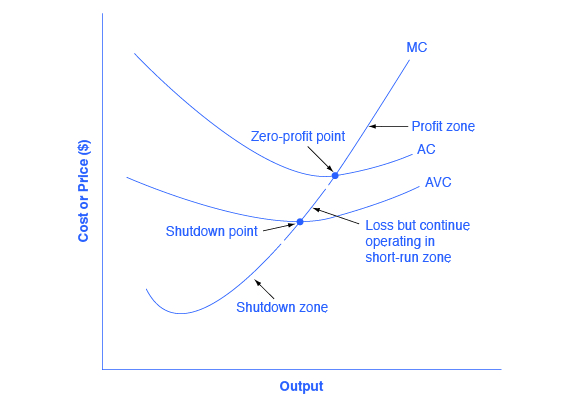

The average cost and average variable cost curves divide the marginal cost curve into three segments, as shown in Figure 8.7. At the market price, which the perfectly competitive firm accepts as given, the profit-maximizing firm chooses the output level where price or marginal revenue, which are the same thing for a perfectly competitive firm, is equal to marginal cost: P = MR = MC.

Figure 8.7. Profit, Loss, Shutdown. The marginal cost curve can be divided into three zones, based on where it is crossed by the average cost and average variable cost curves. The point where MC crosses AC is called the zero-profit point. If the firm is operating at a level of output where the market price is at a level higher than the zero-profit point, then price will be greater than average cost and the firm is earning profits. If the price is exactly at the zero-profit point, then the firm is making zero profits. If price falls in the zone between the shutdown point and the zero-profit point, then the firm is making losses but will continue to operate in the short run, since it is covering its variable costs. However, if price falls below the price at the shutdown point, then the firm will shut down immediately, since it is not even covering its variable costs.

First consider the upper zone, where prices are above the level where marginal cost (MC) crosses average cost (AC) at the zero profit point. At any price above that level, the firm will earn profits in the short run. If the price falls exactly on the zero profit point where the MC and AC curves cross, then the firm earns zero profits. If a price falls into the zone between the zero profit point, where MC crosses AC, and the shutdown point, where MC crosses AVC, the firm will be making losses in the short run—but since the firm is more than covering its variable costs, the losses are smaller than if the firm shut down immediately. Finally, consider a price at or below the shutdown point where MC crosses AVC. At any price like this one, the firm will shut down immediately, because it cannot even cover its variable costs.