The equilibrium of the firm under monopolistic competition follows the usual analysis in the short-run and long-run.

(A) Short-Run Equilibrium Assumptions:

The short-run analysis of the firm under monopolistic competition is based on the following assumptions:

(1) The number of sellers is large and they act independently of each other. Each is a monopolist in his own sphere;

ADVERTISEMENTS:

(2) The product of each seller is differentiated from the other products;

(3) The firm has a determinate demand curve (AR) which is elastic;

(4) The factor-services are in perfectly elastic supply for the production of the product in question;

(5) The short-run cost curves of each firm differ from each other; and

(6) No new firms enter the industry.

Explanation:

Given these assumptions, each firm fixes such price and output which maximises its profits. The equilibrium price and output is determined at a point where the short-run marginal cost curve (SMC) cuts the marginal revenue (MR) curve from below.

Since costs differ in the short-run, a firm with lower unit costs will be earning only normal profits. In case, it is able to cover just the average variable cost, it incurs losses.

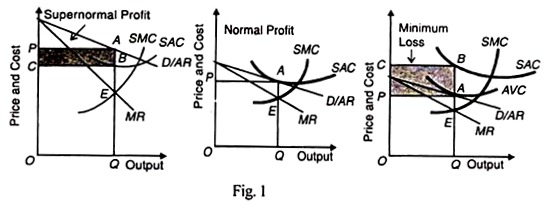

In Figure 1 (A) the short-run marginal cost curve (SMC) cuts the MR curve at E. This equilibrium point establishes the price QA (=OP) and output OQ. As a result, the firm earns supernormal profits represented by the shaded area PABC.

ADVERTISEMENTS:

Figure 1 (B) indicates the same equilibrium point of price and output. But in this case the firm just covers the short-run average unit cost as represented by the tangency of demand curve D and the short-run average unit cost curve SAC at A. It earns normal profits.

Figure 1 (C) shows a situation where the firm is not able to cover its short-run average unit cost and therefore incurs losses. Price set by the equality of SMC and MR curves is QA which covers only the average variable cost.

The tangency of the demand curve D and the average variable cost curve A VC at A makes it a shut-down point. If the firm lowers the price below QA, it will have to stop further production. However at this price, the firm will incur losses equal to the area CBAP during the short-run in the hope of lowering its costs in the long-run.

ADVERTISEMENTS:

It is not essential that during the short-run all firms charge identical prices and produce the same quantity as we have shown above. This is to simplify our geometrical presentation. There being product differentiation, identity of prices and quantities cannot be expected.

Each firm acts in accordance with its own short-run costs and equates its SMC curve with the MR curve. However, this does not mean that the firm fixes a very different price from the other producers. Since its product has close substitutes, its price will have to approximate to the prices of the other firms producing a similar product.

(B) Long-Run Equilibrium:

In the long-run, there is entry and exit of firms in a monopolistic competitive industry as under pure competition, the adjustment process will ultimately lead to the existence of only normal profits. This is a realistic assumption for in the long-run no firm can earn either super-normal profits or incur losses because each produces a similar product.

If firms in the monopolistic competitive industry are earning super-normal profits, new firms will be attracted into the group. With the entry of new firms, the existing market is divided among more sellers so that each firm will sell lesser quantities of the product than before. As a result, the demand curves faced by individual firms shift down to the left. At the same time.

ADVERTISEMENTS:

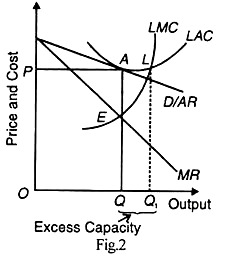

The entry of new firms will increase the demand and hence the price of factor-services will rise which will shift the cost curves of individual firms upward. This two- way adjustment process of lowering the demand curve and raising the cost curves will squeeze out supernormal profits. Thus, each firm will be earning only normal profits in the long-run, as shown in Figure 2.

In the figure, all firms are in the long-run equilibrium at point E where (1) LMC = MR and (2) LMC cuts MR from below, and the LAC curve is tangent to the D/AR curve at point A. Since price QA = LAC at points, each firm is earning normal profits and no firm has the tendency to enter or leave the industry.

This long-run equilibrium analysis under monopolistic competition reveals that each firm and the entire industry will not produce optimum output. There will always be excess capacity. For the firms are not in a position to operate their plants to the maximum capacity and thus enjoy the economies of large scale production fully.

It is evident from Figure 2 where the point of tangency between the demand curve D/AR and the LAC curve is not at the lowest level L. Rather, L is to the right of the point of tangency A. This is because the demand curve D/AR is not horizontal but slopes downward to the right. Thus each firm under monopolistic competition has unutilized capacity even in the long-run.