We have said that monopolistic competition is an amalgam of perfect competition and monopoly. A monopolistically competitive firm does not face a horizontal demand curve. On the other hand, a competitive firm experiences horizontal demand curve since products by all firms are homogeneous. Product differentiation, however, is one of the chief assumptions of monopolistic competition.

In this market, there are no perfect substitutes like perfect competition. Products by large number of monopolistic competitors are closely related to each other.

Each product is a very close substitute of the product of others. It is due to this product differentiation that every firm enjoys some sort of monopoly power since each product is unique. Then the demand curve faced by a monopolistically competitive firm is negative sloping.

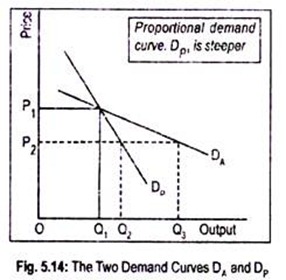

For building up his model of monopolistic competition, Chamberlin considers two demand curves—proportional demand curve, or actual sales curve, and perceived demand curve or anticipated demand curve. The former is drawn by assuming that all the monopolistically competitive firms charge the same price.

On the other hand, a perceived demand curve is drawn on the assumption that the competitor sellers will not change the original price. The curve DP of Fig. 5.14 is the proportional demand curve. This is the demand curve faced by a particular firm when all the sellers charge the same price. DA is the anticipated or perceived demand curve faced the firm if all sellers maintain the original price.

Let us start with a price of OP1 and output sold OQ1. Now if a typical firm wishes a cut in price from OP1 he will expect his sales to go up. This is because Chamberlin assumes that all other firms will keep their prices at OP1.

ADVERTISEMENTS:

Similarly, if the particular seller plans to raise the price of the product, he can expect a drastic drop in sales since all other sellers will keep their price at OP1. Thus, the individual firm perceives a demand curve DA at price OP1 since every seller ‘expects his action to go unnoticed by his rivals’.

DA curve is more elastic than DP because each firm in this model believes that no other firm will react to changes in its price.

Anticipating elastic demand, each firm has an incentive to lower the price of its product in order to capture a larger share of the market. In other words, if a particular firm reduces price of its product from OP1 to OP2, it can expect its sales to increase to OQ3.

ADVERTISEMENTS:

Since every firm hopes that no other firm will cut price, the gain in the ultimate analysis will be smaller. If all firms reduce price to OP2, the actual sales will be QQ2 instead of OQ3. In view of this, DP curve is more steep or less elastic than the DA curve.

DP curve shows the actual sales since it takes into account the effects of the actions of competitive sellers to the price changes. On the other hand, DA curve shows anticipated changes in quantity sold when it contemplates a price change.

Under this market form, every seller believes that his actions will go unnoticed. Thus, every firm ignores the reaction of rival sellers and, hence, behaves independently. All firms acting independently actually sell less than what they anticipate.

However, to make it simple, we have not used anticipated or perceived demand curve to describe equilibrium situation of a firm under monopolistic competition—both in the short run and in the long run.